A SIP calculator helps you plan your investments in mutual funds. It estimates the future value of your investments.

Investing can be confusing. A SIP calculator simplifies this process. SIP stands for Systematic Investment Plan. It allows you to invest a fixed amount regularly in mutual funds. This tool helps you understand how your money can grow. You enter details like the investment amount and time period.

The calculator then shows you potential returns. This makes it easier to set realistic financial goals. Whether you are new to investing or experienced, a SIP calculator can be very helpful. It gives you a clear picture of your investment’s future. So, let’s explore how a SIP calculator can guide your financial journey.

What Is A Sip Calculator?

Investing money can be confusing. Many people find it hard to decide how much to invest. A SIP calculator helps solve this problem. It makes investment planning easier.

A SIP calculator is a tool. It helps you plan your investments. SIP stands for Systematic Investment Plan. This tool shows how much money you can earn. You enter your investment amount, duration, and expected return rate.

How Does A Sip Calculator Work?

The SIP calculator uses a simple formula. It takes your investment amount and duration. Then, it uses the expected return rate. The calculator shows the future value of your investments.

A SIP calculator has many benefits. First, it helps you plan better. You can see how much money you will earn. Second, it helps you stay disciplined. Investing regularly becomes a habit. Third, it reduces risk. You invest small amounts over time.

How To Use A Sip Calculator?

Using a SIP calculator is easy. Follow these steps:

- Enter the amount you want to invest.

- Choose the duration of your investment.

- Enter the expected return rate.

- Click calculate.

The calculator will show you the future value of your investments.

Benefits Of Using A Sip Calculator

A Systematic Investment Plan (SIP) calculator is a valuable tool for investors. It helps to estimate the returns on their SIP investments. This tool aids in planning finances effectively. The calculator is designed to show potential gains over time. It takes into account the investment amount, duration, and expected rate of return. Using a SIP calculator can simplify the investment process. It ensures that you make informed decisions. This blog post will discuss the benefits of using a SIP calculator.

Simplicity

A SIP calculator is very easy to use. Even beginners can operate it without any hassle. Here are some reasons why it is simple:

- User-friendly interface: The calculator has a clean and intuitive layout.

- Minimal input required: You only need to enter a few details.

- Quick results: It provides instant calculations.

The SIP calculator does not require any technical knowledge. You only need to input the monthly investment amount, investment period, and expected return rate. Within seconds, you get the estimated future value of your investment. This helps in making quick decisions.

The simplicity of the SIP calculator saves time and effort. Investors do not need to perform complex calculations manually. The tool does all the work. This ensures that you focus on your investment goals rather than numbers.

Accuracy

The SIP calculator offers accurate results. This accuracy is crucial for financial planning. Here are the reasons why it is accurate:

- Precision in calculations: The tool uses advanced algorithms.

- Considers various factors: It takes into account the rate of return and time period.

- Reduces human error: Manual calculations can be prone to mistakes.

The accuracy of the SIP calculator ensures that you get a clear picture of your investment. It helps in setting realistic financial goals. By providing precise estimates, the tool helps in making informed decisions.

Accurate results also help in comparing different investment options. You can change the input values to see how different scenarios affect your returns. This flexibility ensures that you choose the best investment plan.

In short, the SIP calculator is a reliable tool for investors. Its accuracy helps in effective financial planning and achieving your investment goals.

Key Components Of Sip Calculation

A SIP calculator helps investors understand the potential returns from Systematic Investment Plans (SIPs). It uses factors like investment amount, tenure, and expected returns to estimate the future value. Knowing these key components can help in planning and making informed decisions.

Investment Amount

The investment amount is the money you invest regularly in a SIP. This amount can be as low as $10 or as high as $1,000 or more. The choice depends on your financial goals and capacity.

Here are some things to consider:

- Start with a small amount if you are a new investor.

- Increase the amount as your income grows.

- Make sure the amount fits into your monthly budget.

For example, if you invest $100 monthly, you can use a SIP calculator to see the estimated returns after different periods. The table below shows possible investments and their future values:

| Monthly Investment | Tenure (Years) | Expected Value |

|---|---|---|

| $100 | 10 | $15,000 |

| $200 | 10 | $30,000 |

| $500 | 10 | $75,000 |

Investment Tenure

Investment tenure is the duration you stay invested in a SIP. It can range from 1 year to 30 years or more. Longer tenures often lead to higher returns due to the power of compounding.

Consider the following points:

- Short-term tenure is usually between 1 to 3 years.

- Medium-term tenure is between 3 to 7 years.

- Long-term tenure is more than 7 years.

For example, investing for 10 years might give you better returns than investing for 5 years. The table below demonstrates the impact of different tenures:

| Monthly Investment | Tenure (Years) | Expected Value |

|---|---|---|

| $100 | 5 | $7,000 |

| $100 | 10 | $15,000 |

| $100 | 15 | $25,000 |

Expected Returns

Expected returns are the gains you anticipate from your SIP investments. This rate can vary based on the market and the type of funds you choose.

Factors influencing returns include:

- Market conditions.

- Type of mutual funds (equity, debt, hybrid).

- Economic factors.

For instance, equity funds might offer higher returns compared to debt funds but come with higher risks. The table below shows the potential returns for different types of funds:

| Type of Fund | Expected Annual Return |

|---|---|

| Equity Fund | 10% – 15% |

| Debt Fund | 5% – 8% |

| Hybrid Fund | 7% – 10% |

Using a SIP calculator with these expected returns can help plan your investments better.

How To Use A Sip Calculator

A SIP calculator is a helpful tool for investors. It helps them plan their investments in a Systematic Investment Plan (SIP). This calculator shows how much return you can get from your SIP. It is easy to use and saves time. Let’s learn how to use a SIP calculator effectively.

Step-by-step Guide

Using a SIP calculator is simple. Follow these steps to get accurate results:

- Enter the monthly investment amount: This is the amount you plan to invest each month.

- Choose the investment period: This is the duration you want to keep investing. It can be in months or years.

- Estimate the expected rate of return: This is the annual return rate you expect from your investments.

For example, if you invest $500 each month for 10 years at an 8% annual return rate, the SIP calculator will show the expected returns. The results will include the total amount invested and the total returns.

| Monthly Investment | Investment Period | Expected Return Rate | Total Investment | Estimated Returns |

|---|---|---|---|---|

| $500 | 10 years | 8% | $60,000 | $91,473 |

Using a SIP calculator helps you plan your investments better. It gives a clear picture of your future returns.

Common Mistakes

Many investors make errors while using a SIP calculator. Here are some common mistakes to avoid:

- Ignoring the inflation rate: Inflation affects the value of your returns. Always consider the inflation rate in your calculations.

- Overestimating the return rate: High return rates might not always be achievable. Use realistic return rates for accurate results.

- Not updating the investment period: Make sure to select the correct duration for your investments. Incorrect periods can show wrong results.

Another common error is not adjusting the investment amount. People often forget to increase their monthly investment with time. This can lead to lower returns than expected.

Double-check all inputs before calculating. This ensures you get precise and reliable results. Avoid these mistakes to make the most of your SIP investments.

Types Of Sip Calculators

SIP calculators are tools that help investors plan their Systematic Investment Plans. These calculators estimate the future value of investments. They help in understanding how much wealth can be accumulated over a period. There are different types of SIP calculators available. Each serves a unique purpose and offers various features.

Basic Sip Calculator

A Basic SIP Calculator is simple and easy to use. It helps in calculating the future value of investments. The inputs required are the monthly investment amount, the investment period, and the expected return rate. Once these values are entered, the calculator provides the estimated returns. This type of calculator is ideal for beginners or those who need quick results.

Key Features of Basic SIP Calculator:

- User-friendly interface

- Quick calculations

- Requires minimal inputs

For example, if you invest $100 every month for 10 years, with an expected return rate of 12%, you can easily find out how much your investment will grow. This helps in making informed decisions about future investments. Basic SIP calculators are widely available online. They are free to use and offer immediate results.

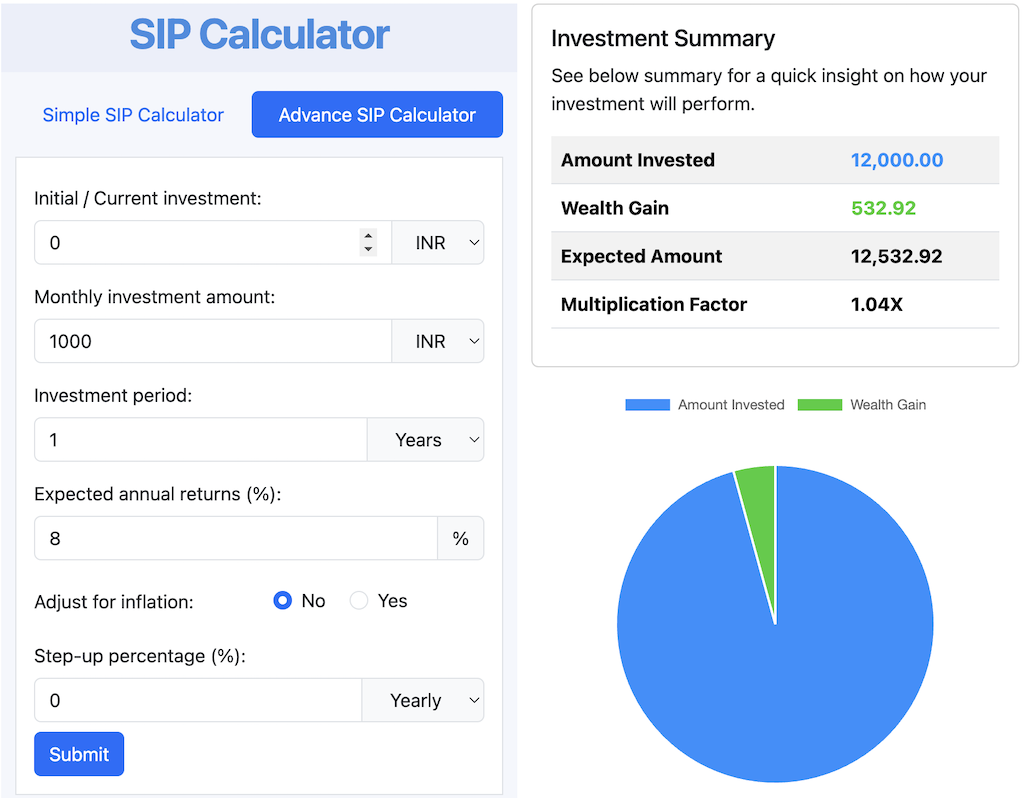

Advanced Sip Calculator

Advanced SIP Calculators offer more detailed analysis. They not only calculate the future value but also provide insights into the investment. They take into account various factors such as inflation, step-up investments, and changing interest rates. These calculators are suitable for experienced investors.

Key Features of Advanced SIP Calculator:

- Detailed analysis

- Considers inflation

- Step-up investment options

- Variable interest rates

For instance, if you plan to increase your investment amount every year, the advanced calculator can handle that. It can show how these changes affect your overall returns. Another feature is the consideration of inflation. This helps in understanding the real value of your investment over time. Advanced SIP calculators are often found on financial websites and may require registration.

Real-life Scenarios For Sip Calculators

A SIP calculator is a useful tool. It helps plan your investments. It can show how small amounts grow over time. This is especially helpful in different life scenarios. Understanding these scenarios can make financial planning easier. Here are some examples of how a SIP calculator can be used effectively.

Retirement Planning

Planning for retirement is essential. A SIP calculator can help. It shows how regular investments can grow. This is important for securing a comfortable retirement.

Consider an example. You start investing $100 monthly at 30 years old. You plan to retire at 60. With an average return of 8%, the SIP calculator can project your final amount. This helps you understand the power of compounding.

Here is a simple table:

| Age | Monthly Investment | Average Return | Final Amount |

|---|---|---|---|

| 30 | $100 | 8% | $149,035 |

Regular investments and starting early are key. Even small amounts can grow significantly. This helps achieve a comfortable retirement.

Child Education Fund

Education costs are rising. Planning early can help manage these expenses. A SIP calculator is useful for this. It helps estimate how much you need to save.

For example, you want to save for your child’s college. The college starts in 15 years. You decide to invest $200 monthly. With an average return of 7%, the SIP calculator can show the final amount.

Here is a simple table:

| Years | Monthly Investment | Average Return | Final Amount |

|---|---|---|---|

| 15 | $200 | 7% | $77,083 |

Understanding this helps in planning better. It ensures you can meet your child’s education costs. Starting early and consistent investments make a big difference.

Comparing Sip Calculators Online

Investing in mutual funds can be confusing. Especially for beginners. A SIP calculator helps you understand how much to invest regularly. It shows the potential returns over time. Comparing SIP calculators online can save you time and effort. It ensures you choose the best tool for your needs.

Top Features

Not all SIP calculators are the same. The best ones have several key features:

- Ease of Use: Simple and user-friendly interface.

- Customizable Inputs: Allows you to input different amounts, durations, and expected returns.

- Detailed Results: Provides a breakdown of your investments and returns over time.

- Graphical Representation: Visual graphs help you understand the growth of your investment.

- Comparison Tool: Compare different SIP plans side by side.

These features make it easier to plan your investments. They help you see the big picture. Choosing a calculator with these features can lead to better financial decisions.

User Experience

A good user experience is crucial for any tool. SIP calculators are no exception. Intuitive design and clear instructions make a big difference. Users should not need to be financial experts to use these tools. The process should be straightforward.

Here are some aspects to consider:

- Navigation: Easy to navigate through the calculator.

- Responsiveness: Works well on mobile devices and desktops.

- Load Time: Quick loading times for immediate results.

- Support: Access to customer support or help sections.

Tools with a good user experience save time and reduce frustration. They make investing more accessible to everyone. A smooth user experience can lead to more confident investment decisions.

Future Of Sip Calculators

SIP calculators are tools that help investors plan their investments in mutual funds. They estimate the future value of regular investments over time. The future of SIP calculators is promising with the integration of new technologies and evolving market trends. These advancements will make the tools more accurate and user-friendly.

Technological Advancements

The future of SIP calculators is bright with technological advancements. Machine learning and artificial intelligence are transforming these tools. They make predictions more accurate and personalized.

Some key advancements include:

- Artificial Intelligence: AI helps in analyzing vast amounts of data. This leads to better investment predictions.

- Machine Learning: Machine learning algorithms improve the accuracy of SIP calculators over time. They learn from past data and adjust predictions.

- Blockchain Technology: Blockchain ensures data security and transparency. It builds trust among users.

- Mobile Applications: Mobile apps make SIP calculators accessible to everyone. They provide convenience and ease of use.

These advancements make SIP calculators more reliable and user-friendly. Investors can make informed decisions with better tools. They save time and effort in planning their investments.

Market Trends

Market trends play a crucial role in shaping SIP calculators. Understanding these trends helps in making accurate predictions. Some important market trends are:

- Increasing Number of Investors: More people are investing in mutual funds. This increases the demand for SIP calculators.

- Rising Awareness: People are becoming more aware of the benefits of systematic investments. This drives the use of SIP calculators.

- Economic Growth: A growing economy leads to higher returns on investments. This makes SIP calculators more attractive.

- Technological Integration: The integration of technology in finance is a major trend. It improves the functionality of SIP calculators.

These trends indicate a positive future for SIP calculators. They will continue to evolve and cater to the needs of investors. Staying updated with market trends helps in making better investment decisions.

Frequently Asked Questions

What Is A Sip Calculator?

A SIP calculator helps you estimate potential returns from your systematic investment plans. It provides insights based on your monthly investment, tenure, and expected rate of return.

How Does A Sip Calculator Work?

A SIP calculator uses the compound interest formula. You enter your monthly investment, tenure, and expected return rate. The calculator then shows your potential future value.

Why Use A Sip Calculator?

A SIP calculator helps you plan your investments better. It provides a clear picture of potential returns, aiding in informed decision-making.

Are Sip Calculators Accurate?

SIP calculators give an estimate based on inputs you provide. They are generally accurate but can’t account for market fluctuations.

Conclusion

Using a SIP Calculator can make investing easier. It helps plan your savings. You can see potential returns clearly. This tool supports better financial decisions. Start using it today. Secure your future. Happy investing!